Furniture and fit out – building up from the pandemic

In this white paper, we turn the spotlight on what has happened to the UK office furniture and fit out sector since lockdown and the implications for the future. As an independent office furniture and fitout leasing company, we have an unbiased view on what has gone on and can look at the sector through a fresh set of eyes. You can also download our white paper on the furniture and fit out sector and how it’s building up from the pandemic by clicking the button below.

Lockdown…

Monday 23rd March 2020, the Government announced the first UK lockdown. As people left their office and headed home, it set in place a motion that has changed the office furniture and fit out sector forever. Pre-pandemic, the likes of Jeremy Corbyn was expelling the virtues of a four-day working week. Friday was becoming a day for many when people would work from home. The workplace was an environment where people had their own desk and went to work to, well, work.

Roll forward two years and the changes to how we work are unprecedented. As many larger London based companies have only just returned to their offices over the last few weeks, employees are returning to a changed work environment.

Monday 23rd March

So, let’s look back to Monday 23rd March, the day most UK businesses closed their doors.

We had just had our best three months in business at WestWon. We were already on course for 157% of our 2020 sales target and the outlook for the rest of the year was incredibly encouraging. Our office furniture and fitout sector was performing very well, companies had been moving offices, upgrading. Suddenly, almost overnight, our prospect list disappeared, the instant impact of lockdown was catastrophic. Overall, our leasing business volumes dropped to 25% of what they should be. Our office furniture and fitout leasing business dropped to zero.

Often when a company is considering an office move, they will discuss how they are going to fund the project even before speaking to a furniture dealer or a D&B company. They may look at a few pictures online to gain some inspiration for their new office aesthetic. However, at this time, most companies have no idea about what seating manufacturer or desk supplier to use. Hence, a leasing company is a good barometer to what the market is saying. We knew straight away; the market was saying that projects were being put on hold or cancelled.

It’s ironic…

The ironic thing is, one of the key challenges to an office refurbishment is that often staff must vacate whilst the works are going on. When we had our offices refurbished, our team had to decamp to a serviced office for three months. It was highly disruptive. So, here we are with an empty office space, a perfect time to make those upgrades. However, as we know, crews were not allowed on site.

The outcome was inevitable; big redundancies and most of the industry was put on furlough. Sadly several well-known fit out companies closed their doors for business.

Researching the financial impact of the Covid pandemic in the UK office furniture and fit out sector

So, what are the financial effects of the pandemic on the UK office furniture and fitout sector?

We have undertaken our own research by analysing the financial accounts of 140 random suppliers of office furniture. The suppliers are based all over the UK, have been trading over a range of years, and are of varied sizes.

With regards to our sample group of UK suppliers, all of whom have their financial year end in March. Hence you can really get a feel for their pre and post pandemic profits. We have only analysed those where they have submitted their March 2019, 2020, and 2021 accounts.

As most of these companies file Abridged Accounts, we cannot see their sales and their true profit will be distorted because of grants and furlough receipts. However, it does give us a feel for what has gone on.

Two years down the line, we can see the financial impact of the pandemic in the UK office furniture and fitout sector. This is what we discovered about the furniture and fit out sector and how it’s building up from the pandemic…

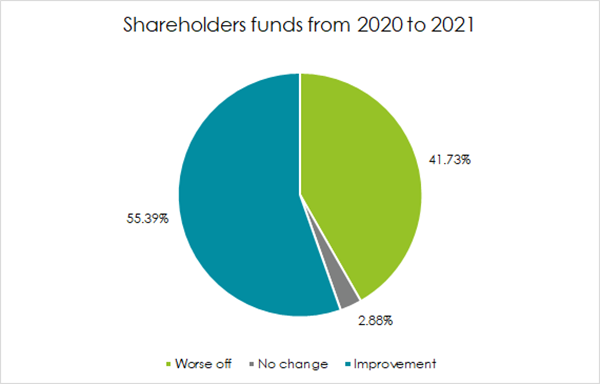

Change in shareholders’ funds

We have analysed our sample data and tracked changes in shareholders’ funds between April 2019 to March 2020 and then also the following year, April 2020 to March 2021. We have only shown one pie chart for illustration as the numbers were identical for both years to the nearest 1%.

Interestingly, over 55% of companies have witnessed an improvement in their net worth over both years. In summary, over half of all office furniture and fitout companies continued to make a profit. When looking at those companies where their net worth / shareholders’ funds have decreased, there will be some that have taken out dividend payments. Hence not all the 41.7% in this category will have lost money.

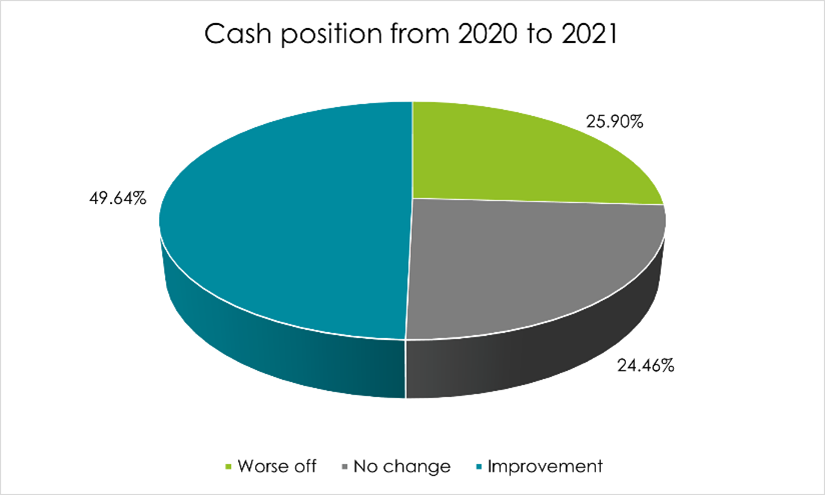

Change in companies cash positions

They say cash is king, so how much cash are companies sitting on?

Again, how the furniture and fit out sector is building up from the pandemic is interesting. Whilst we predicted prior to this exercise that over 50% of companies cash position would be worse, when in reality, it transpired to be quite the opposite.

Between 2019 and 2020, 42% of companies witnessed an improvement in their cash position. The following year, this was nearly 50%. The numbers are slightly varied as just under 25% of companies showed no change in their cash position. This was because they had no cash to report, i.e., they were living off loans or an overdraft in the first place.

In summary, as we moved further into the pandemic, on average, more companies were seeing their cash position improve. A lot of this could be because of the impact of CBILS and Bounce Back lending that was taken up by the office furniture and fit out sector.

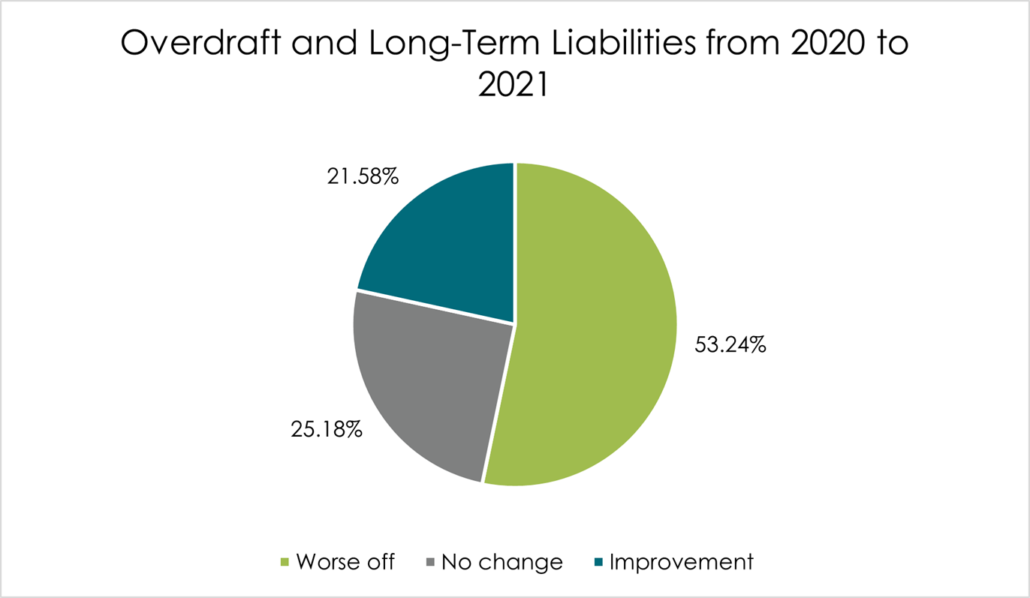

Change in Overdraft and Long-Term Liabilities

This figure represents a company’s overdraft, plus any liabilities due after one year. We felt this was an important number to look at, as it gives us an indication to companies longer term borrowings via CBILS or Bounce Back Loans. Interestingly, quite a few companies have shown through their accounts an increase of exactly £50,000- the maximum you could borrow via a BBL.

Our findings were quite as we predicted. Pre-pandemic, up until the end of March 2020, 37.5% of companies had an improvement in long term liabilities, i.e., their liabilities had decreased. This significantly reduced the following year. As only 21.6% of companies showed improvement, whereas the worse off had gone from 25.9% in 2020 to 53.2% in 2021.

What does this show us, and does it make sense?

In conclusion, over 50% of our random sample has revealed an increase in loans to be repaid back after one year. These loans will need to be serviced, repayments will need to be made, interest paid. Clearly, a great deal of companies have onboarded debt during the pandemic, which is understandable.

It can also be a good explanation as to why companies’ cash positions have improved as well. From what it looks like, a lot of companies have taken out a loan but also have the cash stored away in a bank account. Hence, this position is not as bad as one might think.

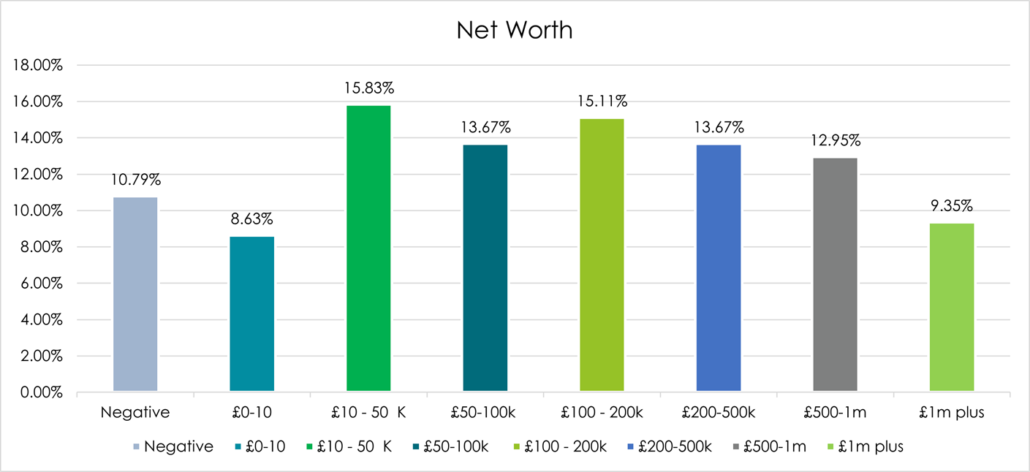

Net Worth / shareholders’ funds

Although this information is not related to how furniture and fitout companies have been trading during or building up from the pandemic, we gathered the data and believe it to be of interest to those in the furniture and fit out sector.

At the bottom end, just under 11% of companies have a negative net worth. Whereas at the top end, just under 10% of companies had shareholders’ funds of more than £1m. So, on average, the data shows a relatively even spread.

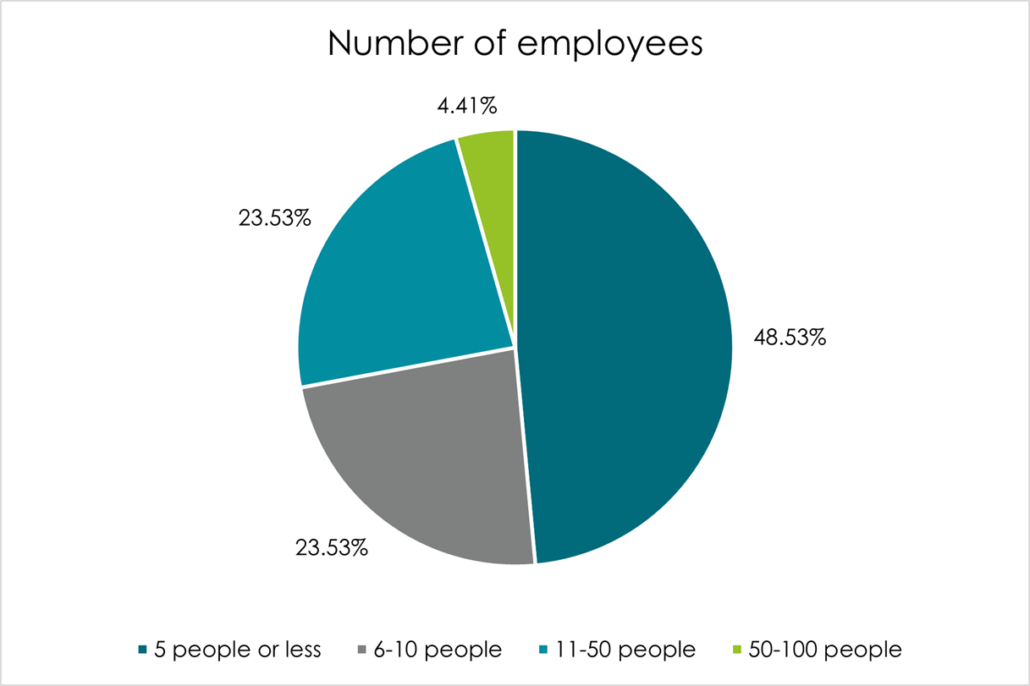

Number of employees per company

Again, this is not related to how the companies are trading, but we believe it is still interesting information.

Just under 50% of our sampled UK furniture and fit out companies employ less than five people and under 5% of companies employ over 50 people.

It is also interesting to note that the furniture and fitout sector is mostly made up of owner / manager SME companies.

Adaptation, what we have seen and what we have heard…

Quite a few suppliers started selling PPE equipment as well as plastic screens, signage, and electronic hand sanitiser dispensers. One company immediately designed a 22” inch screen that displayed a Covid safety message and included underneath was a hand dispenser. A great idea, however, not only have we never seen one in an office, but from our understanding the product was a complete flop.

Some companies thrived off selling a plenitude of office chairs. However, whilst one person reported an extraordinarily strong year, whereby orders of chairs were made in the hundreds for home use, others complained of a downturn. To quote, ‘normally we will do one order for 200 chairs, now we are doing 200 orders for one chair.’

This decline arguably influenced two long established office furniture companies that we deal with to manoeuvre completely into the design, build, and fit out aspect of the business. As their core business of fitting out an office with banks of desks disappeared. This indicates once again that the industry is adapting more than ever before.

Garden offices and meeting pods

Have you met an installer of garden office pods that has not been busy over the last few years? Whilst an office in the garden is nothing new, we have seen much more interest in the leasing and financing of home offices.

In this same genre, meeting pods have popped up everywhere. Service stations, hotels, railway stations, you name it.

We think it is safe to say that the boom of both concepts are products of the pandemic.

What are we noticing as an office furniture and fitout leasing company?

Well, we started this article explaining that at the start of the pandemic, our business dried up overnight. This was the same story for a lot of businesses in 2020, and the first half of 2021. However, the green shoots of recovery sprouted in September 2021 and our business is now back to pre-pandemic levels. Many furniture and fit out businesses will be joining us on their way to building up from the pandemic.

We have now revised our business expectations for 2022. The conversations we are having now are very different to what they used to be. Historically, most companies leased a new fitout when they moved offices. We now have a new type of customer. Those companies who have an incumbent office that they wish to refresh to get their staff back in. Secondly, those customers who are redesigning their office space for a more collaborative approach to business. In summary, less desks, more soft seating and break out areas are becoming the more favourable option.

Summary

There is no doubt about it, this sector has seen some turbulent times over the last few years. However, furniture and fitout companies are adapting. Looking at the financial data, the sector has stood up well to the challenges. 55% of companies have seen an increase in their net worth. In fairness, the rate of increase may have been smaller than expected, but alas, an improvement is an improvement.

The level of debt may cause an issue, loans must be serviced, and interest must be paid.

On average, companies’ liquid cash position has improved which is fantastic for the industry. But we all must be aware, as one Bank Manager told me years ago, more companies go out of business after a recession when they start to overtrade. This is the time we plug the virtues of leasing. It’s a great way to ensure you have great cash flow!

We do not have any data or graphs to illustrate what will happen in the future. It’s merely a gut feeling from what we are hearing and witnessing on a day-to-day basis. There is a lot of activity in the market, and the office furniture and fitout sector is busy quoting. We are confident that 2022 will be a very positive year for all of us.

Contact Us

If you would like more information furniture and fit out and how we are building up from the pandemic, then please contact us on 01494 506 385 or email us on hello@fitout.finance.